Hey there, amazing readers! I’ve been noticing a really interesting shift lately, and I bet you have too if you’ve been paying attention to the financial world.

Private equity – that powerhouse of capital often shrouded in a bit of mystery – is having a serious moment of transformation, not just in its operations but in how *we*, the public, actually see it.

It wasn’t that long ago that “private equity” conjured images straight out of “Barbarians at the Gate,” right? Tales of corporate raiding and ruthless cost-cutting that left jobs and communities reeling.

I mean, who hasn’t heard a story about a company bought out, loaded with debt, and then struggling, sometimes even failing, resulting in significant job losses?

But here’s the kicker: the landscape is changing, and fast. The private equity scene of today, especially looking into 2025 and beyond, is evolving into something far more complex and, frankly, impactful than ever before.

We’re seeing a rebound in deal activity and exits after a couple of slower years, with predictions for a busy 2025 driven by factors like pent-up demand, robust fundraising, and even the explosion of AI and digital infrastructure investments.

Firms are rethinking their traditional playbooks, focusing on specialization, value creation, and even grappling with increased regulatory scrutiny. It’s not just about the numbers anymore; there’s a growing, albeit sometimes contentious, conversation around social impact and sustainability, pushing firms to consider more than just the bottom line.

From what I’ve personally observed, and based on what industry experts are saying, this isn’t just a fleeting trend. We’re witnessing a fundamental recalibration of private equity’s role in our economy, with some even arguing it’s becoming the bedrock of the future economy, financing mature enterprises and driving fundamental growth while many companies stay private longer.

It seems like the public perception is finally catching up, acknowledging the crucial, multifaceted role these firms play, rather than just clinging to outdated stereotypes.

It’s a huge topic with so many layers, from the sheer scale of capital being deployed to the nuances of how these investments truly affect us all. And trust me, understanding these shifts isn’t just for finance buffs; it impacts everything from job markets to innovation.

Let’s dive in and truly get to grips with this fascinating evolution!

Beyond the Stereotypes: A New Face for Private Equity

You know, it wasn’t that long ago that if you mentioned “private equity,” you’d probably get a few eye-rolls or hear hushed whispers about corporate raiders. I remember a time when the dominant narrative painted these firms as cold, calculating entities focused purely on short-term gains, often at the expense of employees and long-term stability. It felt like a constant battle to explain that it wasn’t always about asset stripping or loading companies with crippling debt. But honestly, folks, things are genuinely shifting. The public consciousness, and more importantly, the strategic approach of PE firms themselves, has undergone a significant transformation. We’re moving away from that old, one-dimensional image towards a more nuanced understanding of their role as actual value creators and long-term partners. It’s not just a PR facelift; I’ve seen firsthand how many firms are now deeply invested in operational improvements, technological upgrades, and even fostering a healthier company culture, recognizing that these elements are critical to sustainable growth and, ultimately, higher returns. This change isn’t just cosmetic; it’s a fundamental recalibration driven by market demands, increased transparency, and a genuine desire from limited partners and even the general public to see more responsible capital deployment. It’s truly fascinating to witness this evolution.

From Vultures to Value Architects

The old “vulture capitalist” moniker is definitely losing its grip, and for good reason. What I’m seeing now is a strong emphasis on operational excellence. These firms aren’t just buying companies, tweaking their balance sheets, and flipping them. They’re rolling up their sleeves, bringing in specialized operational partners, and implementing best practices that drive efficiency, innovation, and market penetration. Think about it: when a PE firm acquires a business, they’re not just buying its past performance; they’re investing in its future potential. This often means injecting not just capital, but also strategic guidance, access to broader networks, and a disciplined approach to growth that many smaller or family-owned businesses might not have access to otherwise. I’ve spoken with countless founders who, initially wary, found immense value in the expertise and structured approach that PE partners brought to the table, helping them scale in ways they hadn’t imagined.

Building Bridges: Enhanced Public Engagement

Another striking development is how much more communicative and transparent some private equity firms are becoming. In the past, they were notoriously opaque, often leading to suspicion and misunderstanding. Now, many are actively engaging with the media, publishing thought leadership, and even participating in public forums to demystify their processes and highlight their positive impact. This isn’t just about putting a good face on things; it’s a strategic move to attract talent, build trust with potential acquisition targets, and ultimately, secure more capital from institutional investors who are increasingly sensitive to public perception and ESG factors. From my perspective, this shift towards openness is a healthy one, allowing for a more informed dialogue about the complex, yet vital, role private equity plays in our economic ecosystem.

The Engine Room: How PE Drives Real-World Value Creation

If you really want to understand where private equity is headed, you’ve got to look beyond the headlines and into the engine room—that’s where the real magic, or rather, the real hard work, happens. It’s no longer enough for a PE firm to just be a financial engineer; they’re becoming deeply embedded operational partners. I’ve personally seen firms bring in entire teams of operating advisors who are specialists in areas like supply chain optimization, digital transformation, or even talent management. These aren’t just consultants; these are seasoned executives who roll up their sleeves and work side-by-side with management teams to identify inefficiencies, unlock new revenue streams, and fundamentally improve the business’s core performance. This hands-on approach is what truly differentiates modern private equity. They’re not just looking for quick fixes; they’re investing in the foundational strength of the companies they acquire, knowing that a stronger, more resilient business will ultimately yield better returns down the line. It’s a testament to their understanding that long-term value creation comes from genuine operational excellence, not just clever financial structuring.

Strategic Imperatives: Beyond Financial Engineering

The days of private equity being purely about leveraging debt and stripping assets are, thankfully, largely behind us. What I observe now is a much more sophisticated strategy focused on sustainable growth. This often involves significant investment in R&D, market expansion into new geographies, or strategic bolt-on acquisitions that consolidate market share or add complementary capabilities. For example, I followed a case where a private equity firm acquired a niche manufacturing company and, rather than just cutting costs, they invested heavily in upgrading its aging machinery and implementing advanced robotics, transforming it into a cutting-edge facility. This not only boosted productivity but also created higher-skilled jobs and positioned the company for global competitiveness. This kind of strategic guidance and capital injection, especially for mid-market companies that might struggle to find growth capital elsewhere, is absolutely crucial for economic dynamism. It’s about building stronger, more competitive businesses that can truly thrive.

Unlocking Hidden Potential: Operational Excellence and Digital Transformation

One of the biggest areas where private equity is creating immense value today is through operational excellence and digital transformation initiatives. Many businesses, especially established ones, might be stuck with legacy systems or inefficient processes simply because they lack the capital, expertise, or bandwidth to modernize. This is where PE firms step in, often with dedicated teams or external partners specializing in things like AI integration, cloud migration, or advanced data analytics. I’ve witnessed companies that were operating on decades-old software being completely revolutionized within a few years of PE ownership, streamlining their operations, improving customer experience, and gaining a competitive edge. It’s fascinating to see how they can identify overlooked opportunities for efficiency gains or technological upgrades that can significantly boost profitability and market valuation. They understand that in today’s fast-paced world, staying still means falling behind, and they provide the impetus and resources needed to propel businesses forward.

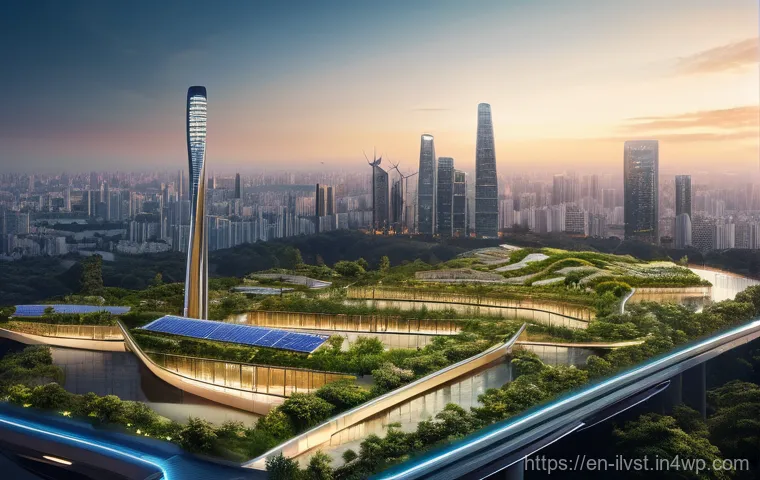

Tech, AI, and Green Gold: New Frontiers for Investment

Alright, let’s talk about where the smart money is heading because this is where things get really exciting, and frankly, a bit mind-boggling in terms of scale. Private equity isn’t just playing catch-up; they’re actively driving the future by pouring vast amounts of capital into cutting-edge sectors. I mean, have you seen the explosion of investment in Artificial Intelligence? It’s not just the venture capital world anymore; PE firms are now actively acquiring mature AI companies or those with strong AI integration capabilities, recognizing that this technology is no longer a futuristic concept but a present-day imperative for almost every industry. But it’s not just AI. Digital infrastructure, cybersecurity, and even groundbreaking biotech are huge magnets for private capital. And let’s not forget the “green gold”—ESG and sustainability-focused investments are absolutely booming. Firms are realizing that investing in renewable energy, sustainable agriculture, or eco-friendly technologies isn’t just about doing good; it’s about making excellent returns because the global demand for these solutions is insatiable. I’ve seen this personally with several funds pivoting their entire strategies to focus on these high-growth, impact-driven sectors. It’s clear that the landscape of opportunity is expanding dramatically, and private equity is right at the forefront, shaping what our future economy will look like.

The AI Revolution: A Private Equity Playbook

The AI revolution isn’t just hype; it’s a fundamental reshaping of industries, and private equity is seizing this opportunity with both hands. It’s not just about investing in nascent AI startups, which is typically venture capital territory. Instead, PE firms are strategically acquiring established companies that either develop AI solutions or can be dramatically enhanced by integrating AI into their operations. I’ve seen deals where a manufacturing company was acquired, and a core part of the value creation thesis was to infuse AI-driven predictive maintenance, supply chain optimization, and automated quality control. The goal isn’t just incremental improvement; it’s exponential transformation. These firms understand that AI isn’t a silver bullet, but when applied strategically, it can unlock unprecedented levels of efficiency, reduce costs, and create entirely new competitive advantages. This targeted, deep integration of AI is a defining characteristic of modern PE investment, promising massive returns for those who execute it well.

Sustainable Investments: Beyond Greenwashing

For a while, “ESG” felt like a buzzword, a checkbox to tick. But trust me, in the private equity world, it’s now a core investment thesis, especially when it comes to environmental sustainability. Firms are genuinely seeking out and pouring billions into companies focused on renewable energy, sustainable infrastructure, clean technology, and resource efficiency. This isn’t just “greenwashing”; it’s a profound recognition that these sectors are not only crucial for our planet but also represent immense, untapped economic opportunities. I remember a conversation with a fund manager who articulated it perfectly: “The world *needs* these solutions, and where there’s fundamental need, there’s market opportunity.” They’re investing in everything from large-scale solar farms to innovative waste-to-energy solutions and sustainable agriculture technologies. This proactive approach to environmentally sound investments is becoming a significant driver of returns and a major component of PE portfolios, reflecting a broader societal shift towards a more sustainable future.

Walking the Tightrope: Regulatory Scrutiny and ESG Imperatives

If you’re in the private equity world today, you’re definitely feeling the heat from a couple of directions: increased regulatory scrutiny and the growing, undeniable imperative of ESG (Environmental, Social, and Governance) factors. It’s like walking a tightrope, balancing profit motives with a much broader set of responsibilities. Gone are the days when firms could operate in relative obscurity without much oversight. Regulators, particularly in the U.S. and Europe, are paying much closer attention to everything from transparency in fees to potential market impacts of large acquisitions. And honestly, it’s about time. This increased scrutiny isn’t just a hurdle; it’s pushing firms to operate with greater discipline and accountability. Beyond that, ESG isn’t just a “nice-to-have” anymore; it’s a fundamental part of the investment decision-making process. Limited partners (the institutional investors who commit capital to PE funds) are demanding it, employees are demanding it, and increasingly, the general public expects it. This means firms are now having to integrate things like carbon footprint analysis, diversity metrics, and ethical supply chain considerations into every aspect of their due diligence and value creation strategies. It’s a complex, but ultimately healthy, evolution for the industry, pushing it towards a more responsible and sustainable form of capitalism.

Navigating the Regulatory Maze

The regulatory landscape for private equity has become significantly more complex, and frankly, a bit of a minefield if you’re not careful. Governments globally are keen to ensure fair play, prevent monopolies, and protect workers and consumers, leading to a proliferation of rules and oversight. I’ve heard countless stories from compliance officers about the sheer volume of new reporting requirements, heightened anti-trust reviews, and increased focus on investor protection. For example, recent developments from the SEC in the U.S. have really put pressure on private fund advisers regarding fee transparency and disclosure practices. It’s no longer just about financial performance; firms must demonstrate robust governance, ethical conduct, and strict adherence to a constantly evolving set of regulations. This requires not just legal expertise but a deep, ingrained culture of compliance throughout the organization. While it can be challenging, I believe this increased oversight ultimately fosters a more trustworthy and stable financial environment, benefiting everyone in the long run.

ESG as a Core Investment Driver

What started as a niche consideration has rapidly become a core driver in private equity, and I mean *core*. ESG factors are no longer just about public relations or avoiding negative press; they are fundamentally integrated into how firms identify, assess, and manage their investments. Investors, particularly large pension funds and endowments, are explicitly incorporating ESG criteria into their mandates, demanding that PE funds demonstrate how they are addressing environmental impact, ensuring social equity, and upholding strong governance. I’ve seen this evolve from simple questionnaires to sophisticated data analytics that score companies on their ESG performance. Firms that can genuinely demonstrate a commitment to improving these metrics across their portfolio companies are finding it easier to attract capital and generate long-term value. It’s a recognition that strong ESG practices correlate with reduced risk, improved operational efficiency, and enhanced brand reputation, making them not just ethical choices but smart business decisions. This shift is profound and reshaping the very fabric of private equity investment.

The Talent Game: Attracting and Retaining Top-Tier Expertise

Let’s get real for a moment: at the heart of any successful private equity firm or any successful company, for that matter, are its people. And in today’s fiercely competitive landscape, the talent game is more intense than ever. It’s not just about attracting brilliant financial minds anymore, though those are still crucial, of course. What I’m seeing is a massive push to recruit and retain a much broader spectrum of expertise. Firms are actively seeking out operational specialists, digital transformation experts, AI ethicists, data scientists, and even seasoned executives with deep industry-specific knowledge who can genuinely add value to portfolio companies. The war for talent is fierce, and compensation packages are just one piece of the puzzle. Firms are focusing heavily on creating compelling cultures, offering clear career pathways, and providing opportunities for meaningful impact. It’s a recognition that intellectual capital and human capital are often the most valuable assets a firm possesses, and investing in them is paramount for long-term success. I’ve witnessed firms struggle when they underestimated this aspect, and conversely, seen others soar when they truly prioritized building exceptional teams.

Beyond Bankers: The Rise of Operational Partners

One of the most significant shifts in private equity talent acquisition is the growing emphasis on operational partners. These aren’t just external consultants brought in for a specific project; many are now full-time, integrated members of PE teams. They’re seasoned industry veterans who have run businesses, tackled complex operational challenges, and possess deep, practical knowledge. I remember a fund manager telling me, “We’re not just buying a company; we’re buying the opportunity to make it better. And to do that, you need people who’ve actually *done* it.” These operational gurus work directly with the management teams of portfolio companies, helping to implement best practices, optimize supply chains, streamline production, and drive digital transformation. They provide hands-on guidance that goes far beyond what a typical financial analyst could offer, truly contributing to the value creation thesis. This emphasis on practical, experienced operators is a game-changer and highlights how PE has evolved from purely financial arbitrage to active business building.

Cultivating a Winning Culture: Retention Strategies

Attracting top talent is one thing, but retaining them is an entirely different ballgame, especially in a demanding environment like private equity. Firms are keenly aware that their greatest asset walks out the door every evening, so they’re investing heavily in creating a compelling employee experience. This goes beyond competitive salaries and bonuses. I’ve seen firms implement innovative programs focusing on professional development, mentorship, and even mental wellness support. There’s a growing recognition that a positive, collaborative, and purpose-driven culture is essential for retaining high-performers. Many firms are also emphasizing diversity and inclusion initiatives, understanding that diverse perspectives lead to better decision-making and innovation. It’s about fostering an environment where individuals feel valued, challenged, and empowered to make a real impact, both within the firm and across its portfolio companies. This focus on cultivating a winning culture is not just a HR trend; it’s a strategic imperative for long-term success in the talent-driven private equity landscape.

The Long View: Why Companies Stay Private Longer and PE’s Role

This is a fascinating trend that I’ve been watching closely, and it really underscores the evolving role of private equity in our economy. For decades, the conventional wisdom was that a successful company would eventually “go public” – an IPO was seen as the ultimate badge of honor and the natural progression for growth. But guess what? That narrative is definitely changing. We’re seeing more and more incredibly successful, mature companies opting to stay private for much longer, sometimes indefinitely. Why? Well, from what I’ve gathered, and from my own observations, it often boils down to a desire for strategic flexibility, insulation from short-term market pressures, and the ability to make bold, long-term investments without the constant scrutiny of quarterly earnings reports. And this is exactly where private equity steps in as a crucial partner. PE firms provide that essential growth capital and strategic guidance, allowing companies to innovate, expand, and weather economic cycles without the immense compliance costs and public market volatility that come with being listed. It’s a powerful testament to how private capital is becoming the bedrock for sustainable, long-term enterprise growth, challenging the traditional view of capital markets and cementing private equity’s vital role in financing the future.

Escaping the Public Eye: Advantages of Private Ownership

The allure of staying private is stronger than ever, and frankly, I completely get why. Imagine trying to innovate a disruptive technology or undertake a massive, multi-year strategic pivot while simultaneously dealing with activist shareholders, fluctuating stock prices, and the relentless pressure to meet quarterly analyst expectations. It’s exhausting! Private ownership, often backed by private equity, offers companies a crucial sanctuary from this short-termism. It allows management teams to focus on long-term value creation, make strategic investments that might not pay off for years, and navigate economic downturns with greater agility. I’ve seen companies thrive by staying private, able to experiment with new business models, acquire smaller competitors without public market fanfare, and build sustainable competitive advantages away from the glare of daily market speculation. This freedom to operate strategically, without the constant noise, is a powerful advantage that more and more founders and CEOs are recognizing and embracing.

PE as the New Growth Capital Provider

In this era where companies are staying private longer, private equity has truly stepped up to become the primary provider of growth capital for mature enterprises. Think about it: traditional venture capital typically focuses on early-stage, high-risk ventures. Public markets, while still vital, are becoming less appealing for companies looking for patient capital that understands and supports long-term strategic plays. Private equity fills this gap perfectly. They’re providing the multi-million or even multi-billion dollar injections needed for established businesses to scale, enter new markets, or undergo significant technological transformations. I’ve observed PE firms acting as true partners, not just funders, bringing not only capital but also invaluable expertise, networks, and governance structures that help these companies navigate complex growth trajectories. This shift firmly establishes private equity as an indispensable component of the modern financial ecosystem, driving significant economic activity and fostering innovation across a vast array of industries. It’s a testament to their adaptability and crucial role in today’s economy.

| Aspect of Private Equity | Traditional View (Old Stereotypes) | Modern Approach (2025 and Beyond) |

|---|---|---|

| Primary Objective | Short-term profit, debt-fueled returns, asset stripping. | Long-term value creation, operational excellence, sustainable growth. |

| Relationship with Management | Imposing strict controls, often confrontational. | Collaborative partnership, providing strategic guidance and resources. |

| Focus Areas | Mature, often struggling companies ripe for cost-cutting. | High-growth sectors (Tech, AI, ESG), digital transformation, operational improvement. |

| Public Perception | “Barbarians at the Gate,” job losses, ruthless. | Economic engine, value creator, increasingly socially conscious. |

| Regulatory Environment | Lower scrutiny, less transparency. | Heightened scrutiny, demand for transparency and accountability (ESG). |

| Exit Strategy | Quick flip, often through debt-laden recapitalizations. | Strategic sales, IPOs, secondary buyouts driven by sustained operational improvement. |

Wrapping Things Up

So, there you have it – a much clearer, and I hope, more compelling picture of private equity today. It’s a far cry from the old narratives, isn’t it? What I’ve seen over the years is a profound evolution, driven by smart people genuinely committed to building stronger businesses and creating lasting value. It’s less about abstract finance and more about tangible impact, from technological innovation to sustainable practices. My hope is that this deep dive has demystified some of the complexities and shown you how these firms are truly shaping the economic landscape for the better, often behind the scenes, yet with immense influence. It’s a dynamic, exciting space, and I’m genuinely thrilled to see where it goes next!

Handy Bites of Wisdom

1. Private equity isn’t just for giant corporations; many firms actively invest in mid-sized businesses, helping them scale and innovate.

2. Modern PE deals often prioritize operational improvements and digital transformation over purely financial engineering.

3. ESG (Environmental, Social, Governance) factors are now a critical part of investment decisions, not just a marketing buzzword.

4. Companies are staying private longer, and PE is a key partner in providing patient capital and strategic guidance for sustained growth.

5. The industry is a major job creator, often bringing in specialized talent to help portfolio companies thrive in new markets.

The Big Picture, Simplified

In essence, private equity has shed its old skin. It’s now a powerful force for long-term value creation, deeply invested in operational excellence, innovation, and sustainable practices. The focus is firmly on building better businesses, supported by strategic partnerships and a keen eye on future trends like AI and green technologies. It’s a complex world, but one that’s increasingly transparent and undeniably vital to our global economy.

Frequently Asked Questions (FAQ) 📖

Q: uestions

A: bout The Evolving Private Equity Landscape

Q: Is private equity still just about “corporate raiding” and job cuts, or has its image really changed?

A: Oh, my friend, this is the million-dollar question, isn’t it? For the longest time, the public image of private equity was stuck in the “Barbarians at the Gate” era, picturing firms as ruthless corporate raiders interested only in asset stripping and massive layoffs to make a quick buck.

And honestly, some historical instances certainly fed into that narrative, causing real pain in communities. But from what I’ve seen firsthand and through countless industry reports, that perception is genuinely shifting, and for good reason.

Today’s private equity landscape, especially as we head into 2025, is far more nuanced. Firms are increasingly focused on value creation rather than just cost-cutting.

This means they’re looking to invest in companies, provide strategic guidance, infuse capital for growth, and improve operational efficiency over several years, not just flip them for a fast profit.

We’re talking about genuine long-term partnerships that can revitalize businesses, encourage innovation, and even create new jobs. Of course, the drive for returns is still there – it’s capitalism, after all!

– but the methods have matured significantly. It’s less about the smash-and-grab and more about building and optimizing. The industry is also becoming far more transparent and, dare I say, accountable, largely due to increased public and regulatory scrutiny, which frankly, I think is a good thing for everyone involved.

Q: What’s driving this “recalibration” of private equity, especially looking towards 2025?

A: This “recalibration” isn’t happening in a vacuum; it’s a fascinating mix of internal strategy shifts and external market pressures. First off, a massive driver is the sheer amount of dry powder – uninvested capital – that private equity firms have.

After a couple of slower years, there’s pent-up demand to deploy this capital, and that means looking for smarter, more sustainable investment opportunities.

We’re also seeing an incredible boom in technological innovation, particularly with AI and digital infrastructure. These aren’t just buzzwords; they represent entirely new sectors for investment and growth, pushing firms to specialize and become experts in niche areas rather than being generalists.

Personally, I’ve noticed how many firms are now specifically looking for companies that can leverage AI for operational improvements or that are building the very infrastructure AI needs.

Beyond that, regulatory scrutiny is undeniably increasing, pushing firms to adopt better governance and more responsible practices. And let’s not forget the growing investor demand for ESG (Environmental, Social, and Governance) considerations.

Limited Partners (LPs) – the institutions investing in private equity funds – are increasingly asking about a firm’s impact beyond just financial returns.

This means firms are now expected to consider social impact and sustainability, not just as a nice-to-have, but as a core part of their strategy, which I find incredibly promising.

It’s all about sustainable growth and proving a more holistic value proposition.

Q: How does private equity actually impact us – the average person – in our daily lives, beyond just the big financial headlines?

A: This is where it gets really interesting and, frankly, often goes unnoticed by most people! While private equity might seem like a world removed from your everyday life, its influence is far more pervasive than you might imagine.

Think about it: private equity funds often own the brands you buy, the services you use, and even the infrastructure you rely on. For example, that popular coffee shop chain you love, the healthcare provider you visit, or even the software company that powers your favorite app – many of these are, or have been, backed by private equity.

What does this mean for you? Well, when a private equity firm invests, they often bring capital, strategic expertise, and operational improvements that can lead to better products, more efficient services, and sometimes even more competitive pricing.

On the flip side, as we discussed, if an investment doesn’t go well, there can be impacts on employment or service quality. However, the shift towards value creation means many firms are genuinely trying to grow these businesses, which can lead to job creation, better working conditions as companies become more profitable, and increased innovation that benefits consumers.

Personally, I’ve seen small businesses get the capital injection they needed from private equity to expand, hire more staff, and even launch new products that I now use daily!

It’s all interconnected, and understanding this helps us appreciate the powerful, if often invisible, hand private equity plays in shaping our economy and our daily experiences.